- WallStreetWindow

- Posts

- What Is Next For The Chinese Stock Market After These Wild Moves Up And Down?

What Is Next For The Chinese Stock Market After These Wild Moves Up And Down?

Become A Better Trader And More Informed Investor

Investors around the world are counting down for the Israel attack against Iran, to see how it will impact the international oil markets, and how much bigger the conflict in the Middle East will get.

It’s coming any day now and after it does people will be counting down for the US Presidential election in November.

Meanwhile, we have seen some wild moves in the markets this year, but nothing may beat what the Chinese stock market has done this month. The stock market in China simply soared last month once it’s central bank announced the equivalent of interest rate cuts.

It’s stock market, though, came out of a stage one base and rocketed up, as you can see from the FXI ETF, but this week it pulled back sharply.

So, what is next?

Take a look at the Bollinger Band width indicator on the bottom of the chart.

It was below 10 a month ago and jumped all the way above 50.

It did that because the price volatility exploded.

When that happens like this typically volatility will contract for several weeks.

So, look for the Bollinger Band width indicator to come back down to take back at least half of its gains.

That means the Chinese stock market is likely to simply go sideways for the next few weeks, before making another sustainable move.

If you were paying attention to my updates in March, you saw this happen with gold and silver back then.

No “AI” was used to write this email or edit it.

In an internet where so much is phony and fake, as of today, 9,408 real people subscribe to this email newsletter.

Top Financial News Of The Day

Crypto Guru Carnival Barkers

Real Market Commentators

Also Of Interest

And…..

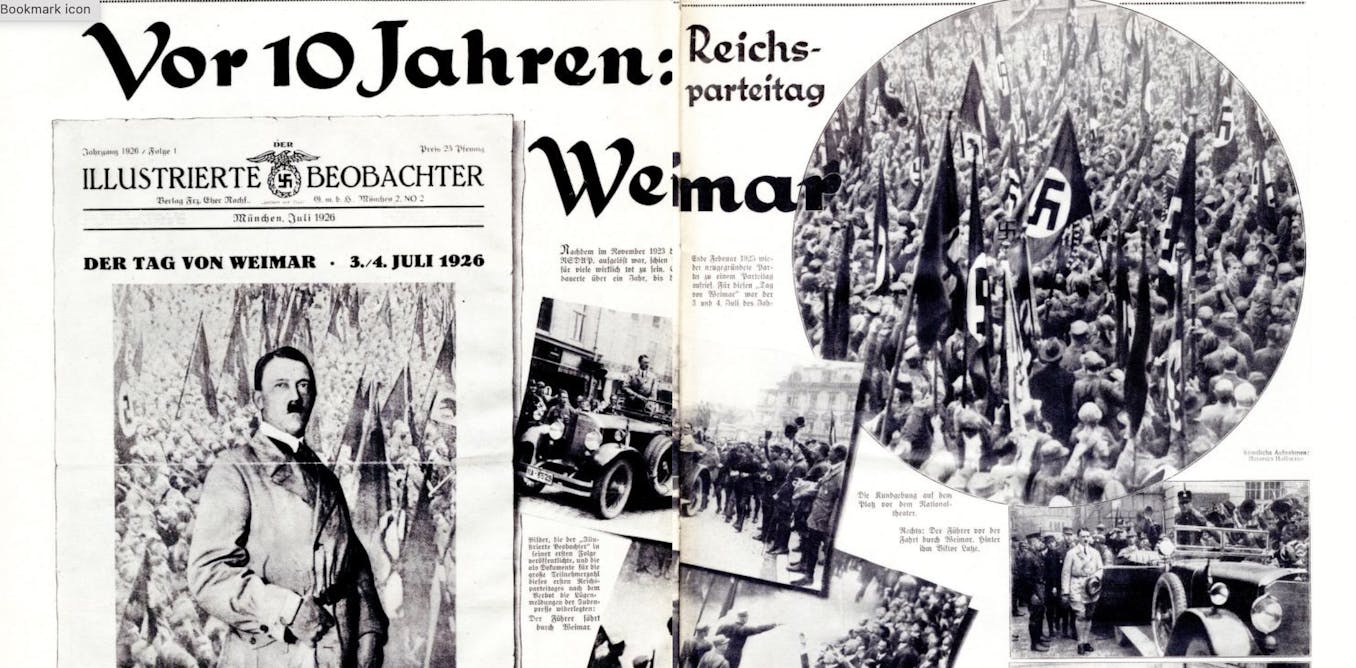

No one wants to think about this.

Or this….

To believe that you can get into trading and win by opening up a Robinhood app and watching some Youtube videos, without reading or studying anything for real, is insane.

And yet, this is exactly what Bitcoin gurus have taught millions of people who have gotten into the markets since 2020 to think they can do. They are speaking to people with low comprehension skills who are financially illiterate.

The dumb money in the markets is the real opportunity to make money off when the time is right, but if all you do is listen to the Bitcoin gurus you don’t know anything.

-Mike

Disclaimer: The opinions expressed in this newsletter are those of WallstreetWindow its editors and contributors, and may change without notice. The information in this newsletter may become outdated and we have no obligation to update it. The information in this newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with a financial adviser prior to making any investments, including whether any investment is suitable for your specific needs. WallStreetWindow is owned by Timingwallstreet, Inc. and it is not a registered investment advisor and does not provide individual investment advice. This is a publication for the general public.