- WallStreetWindow

- Posts

- Is This The Stock To Buy To Play National Capitalism?

Is This The Stock To Buy To Play National Capitalism?

Become A Better Trader And More Informed Investor

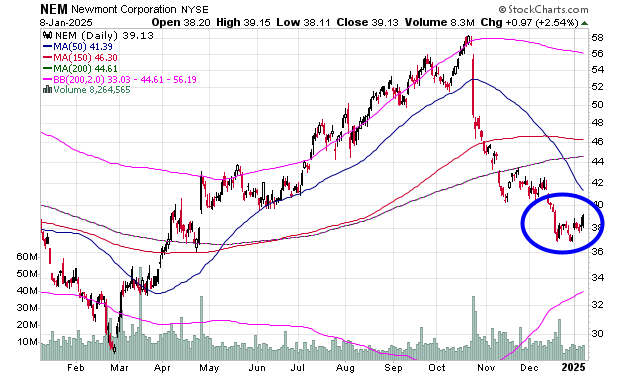

Newmont Mining now has an entry point for anyone who wants to take it.

All they have to do is buy and if they want to they can then put a stop loss order in below it’s recent low around $37.00 a share.

The stock is paying a 2.56% dividend and is one of the largest gold mining companies in the world.

It had a huge run from March, until the end of October, and then got smashed after it reported earnings that disappointed the market, because they showed a big jump in labor costs and energy costs.

Yes, inflation has not gone away, but as the biggest gold miner in the world Newmont is poised to benefit from inflation and growing geopolitical tensions, which help bring big money buyers into gold.

As you know central banks around the world have been accumulating gold.

We are now entering an era of what one is labeling “national capitalism.”

One thing that means is increased global tensions.

And if you watched Trump the other day you will know that he laid down big warnings against Canada, Panama, Mexico, and Greenland. The people in those countries may not like it, but the leaders have been warned and Trump did not rule out military action against Greenland to annex it at his press conference this week.

Whatever you think about that, it’s obvious that more global and economic instability is just going to come in the next few years. That’s the simple conclusion. You could say right now is simply the calm before the storm.

Yes, I own NEM stock and SeekingAlpa is calling it a “once in a generation buy” right here.

-Mike

No “AI” was used to write this email or edit it.

In an internet where so much is phony and fake, as of today, 9,408 real people subscribe to this email newsletter.

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone, has already helped consumers earn over $325M!

Their pre-IPO offering is live at just $0.26/share – don’t miss it.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Top Financial News Of The Day

Market Commentators

Also Of Interest

And…..

The phrase “national capitalism” is something I got from an article by Russell Napier.

I suggest you check it out, because it’s worth the time to read:

-Mike

Disclaimer: The opinions expressed in this newsletter are those of WallstreetWindow its editors and contributors, and may change without notice. The information in this newsletter may become outdated and we have no obligation to update it. The information in this newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with a financial adviser prior to making any investments, including whether any investment is suitable for your specific needs. WallStreetWindow is owned by Timingwallstreet, Inc. and it is not a registered investment advisor and does not provide individual investment advice. This is a publication for the general public.