- WallStreetWindow

- Posts

- Gold Price Sends Buy Signal As GLD/SPY Ratio Breaks Through Three Year Old Resistance

Gold Price Sends Buy Signal As GLD/SPY Ratio Breaks Through Three Year Old Resistance

Become A Better Trader And More Informed Investor

Gold broke out of a three year resistance high last year when it closed above $2100 almost exactly a year ago.

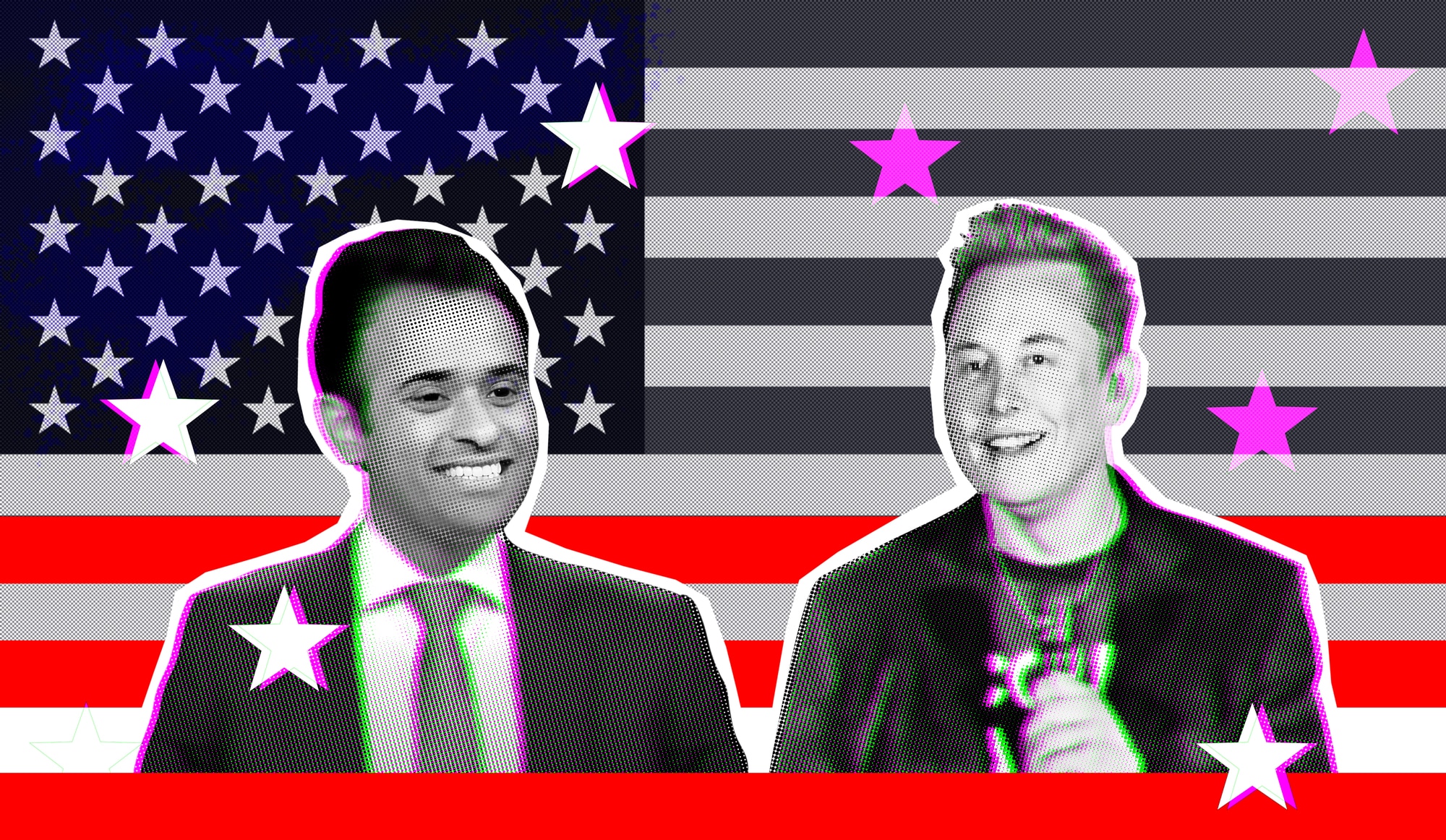

It has been trending up ever since, even though the masses have ignored the rally, favoring Bitcoin ETF’s, which have broken down this year through support. Bitcoin crashes when the stock market simply corrects, but Bitcoin gurus did not explain that to people when they promoted the Bitcoin ETF’s last year and still do. Now people can buy Trump and Melanie MEME coins.

Now yesterday, something huge happened with gold that the crypto gurus are not telling you.

Take a look at the chart of gold below and the gold/S&P 500 ratio on the bottom of it.

The gold/$spx ratio broke through a level this week that has acted as resistance on it for the past three years.

Gold is now outperforming the S&P 500, the US stock market, and this signal tells us that it is likely to do so for the rest of this year, and maybe beyond that, because it is a long-term technical signal.

Whatever you think of the Trump moves, geopolitical tensions around the world are increasing. He declared at his Tuesday Congressional speech that he is dead serious about taking control of Greenland. US relations with Russia have rapidly softened, but tensions between it and Canada, Mexico, China, and Europe have increased. Central banks in several of those countries, and regions, have been accumulating gold for years and are likely to continue to do so. The US dollar index took a hit yesterday as the Euro surged against it. The German stock market, when priced in US dollars, made a new 52-week high yesterday. There is more to the financial markets than the price of Bitcoin and NVDA.

This year President Trump turned himself into the world biggest crypto salesman with the launch of his Trump meme coin and government crypto reserve. The problem for people who buy into crypto news like this is, because crypto represents ownership in nothing, and is basically used for pump and dumps, all the virtual coins do on the announcements is gap up and then sell-off. The purpose of virtual crypto coins is to make the people who create them rich, while giving those that buy them the opportunity to gamble and dream with their purchase.

-Mike

No “AI” was used to write this email or edit it.

In an internet where so much is phony and fake, as of today, 9,408 real people subscribe to this email newsletter.

Tackle your credit card debt by paying 0% interest until nearly 2027

Reduce interest: 0% intro APR helps lower debt costs.

Stay debt-free: Designed for managing debt, not adding.

Top picks: Expert-selected cards for debt reduction.

Top Financial News Of The Day

Market Commentators

Also Of Interest

And…..

Last week the Nasdaq fell to its 200-day moving average and bounced hard.

On Monday it gapped up and then gave up its Friday gains, but managed to rally yesterday.

Let’s hope this level can hold, the market is trying to grab its footing here.

If it doesn’t and goes through the recent low then we are looking at a coming VIX spike.

-Mike

Disclaimer: The opinions expressed in this newsletter are those of WallstreetWindow its editors and contributors, and may change without notice. The information in this newsletter may become outdated and we have no obligation to update it. The information in this newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with a financial adviser prior to making any investments, including whether any investment is suitable for your specific needs. WallStreetWindow is owned by Timingwallstreet, Inc. and it is not a registered investment advisor and does not provide individual investment advice. This is a publication for the general public.

.jpg)