- WallStreetWindow

- Posts

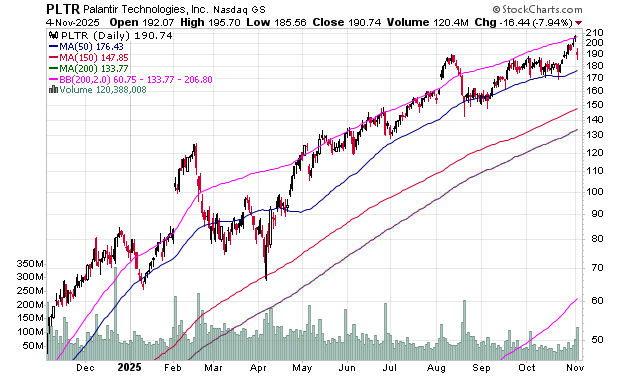

- Big Tech Stock Palantir Gets Hit Hard As CEO Blames Short Sellers

Big Tech Stock Palantir Gets Hit Hard As CEO Blames Short Sellers

Become A Better Trader And More Informed Investor

Yesterday, the stock market took a hit, with selling swamping some of the big tech stocks. People are taking profits, as everything ran up so much in the past few months, but I’m still confident that the market will be ok for the rest of this year.

PLTR was one of the big names that got hit the hardest after it reported earnings on the close Monday.

The CEO of the company blamed “market manipulation” and “short sellers” for the decline in the stock and even got on CNBC to make these claims. In my 30 years of doing this now, every time I have seen a CEO go on TV and react like that to a stock price decline it has turned out to be a massive red flag. I would be scared to own this as a long-term investment now, much less buy it.

Sure, it probably will bounce back, and do ok the rest of this year, but I would have zero confidence in where this stock market be at a year from now - and I don’t care if one of it’s co-founders created the Vice President JD Vance and owns him. The main thing is that it has become a meme stock with a P/E of 633. It has a forward P/E of about half that number and a PEG ratio over 3.

I’m not short selling it either.

I have zero interest in doing anything with it.

As for gold, it’s still in a correction/consolidation mode, just like all the markets are in at the moment, and I’ll have more to say about that soon. I’d recommend taking a look, though, at a video update by Jordan Roy-Byrne of thedailygold.com did that you can find here. Jordan sees a gold consolidation until it hits its 200-day moving average and that makes sense to me. That indicator is slowly moving up and if gold were to stay around here will get to this level in the first few months of next year. We last saw gold consolidate this past spring and summer and it looks like something similar is playing out.

-Mike

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Top Financial News Of The Day

Real Market Commentators

Also Of Interest

Most coverage tells you what happened. Fintech Takes is the free newsletter that tells you why it matters. Each week, I break down the trends, deals, and regulatory shifts shaping the industry — minus the spin. Clear analysis, smart context, and a little humor so you actually enjoy reading it.

Disclaimer: The opinions expressed in this newsletter are those of WallstreetWindow its editors and contributors, and may change without notice. The information in this newsletter may become outdated and we have no obligation to update it. The information in this newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with a financial adviser prior to making any investments, including whether any investment is suitable for your specific needs. WallStreetWindow is owned by Timingwallstreet, Inc. and it is not a registered investment advisor and does not provide individual investment advice. This is a publication for the general public.